30 YEARS OF EXCELLENCE

Midwest Multifamily Investments that build Family Legacies

Helping families generate monthly income, preserve capital, and provide peace of mind through strategic real estate investments.

THE PROBLEM

You've done everything right, but you still don't feel secure

You've contributed to your 401(k), sat through volatility, and stayed patient through every cycle. Still, your financial future feels tethered to headlines you can't control.

Each year, taxes take a little more and your retirement years feel less predictable.

Founded and led by Marc Strickling

30

Years of Real Estate Experience

Owned, managed, and exited multifamily properties across three economic cycles

CFP

Certified Financial Planner™

Professional expertise in financial planning and investment strategy

$$$

Personally Invested

Every deal we present is one he's invested in himself

Our decisions reflect the same standard applied to our family’s capital: stable income, preserved principal, and long-term viability.

Cash flow is king and it’s our underwriting starting point.

- Marc Strickling

WHAT WE DO

We acquire income-producing multifamily assets and strengthen them for long-term performance

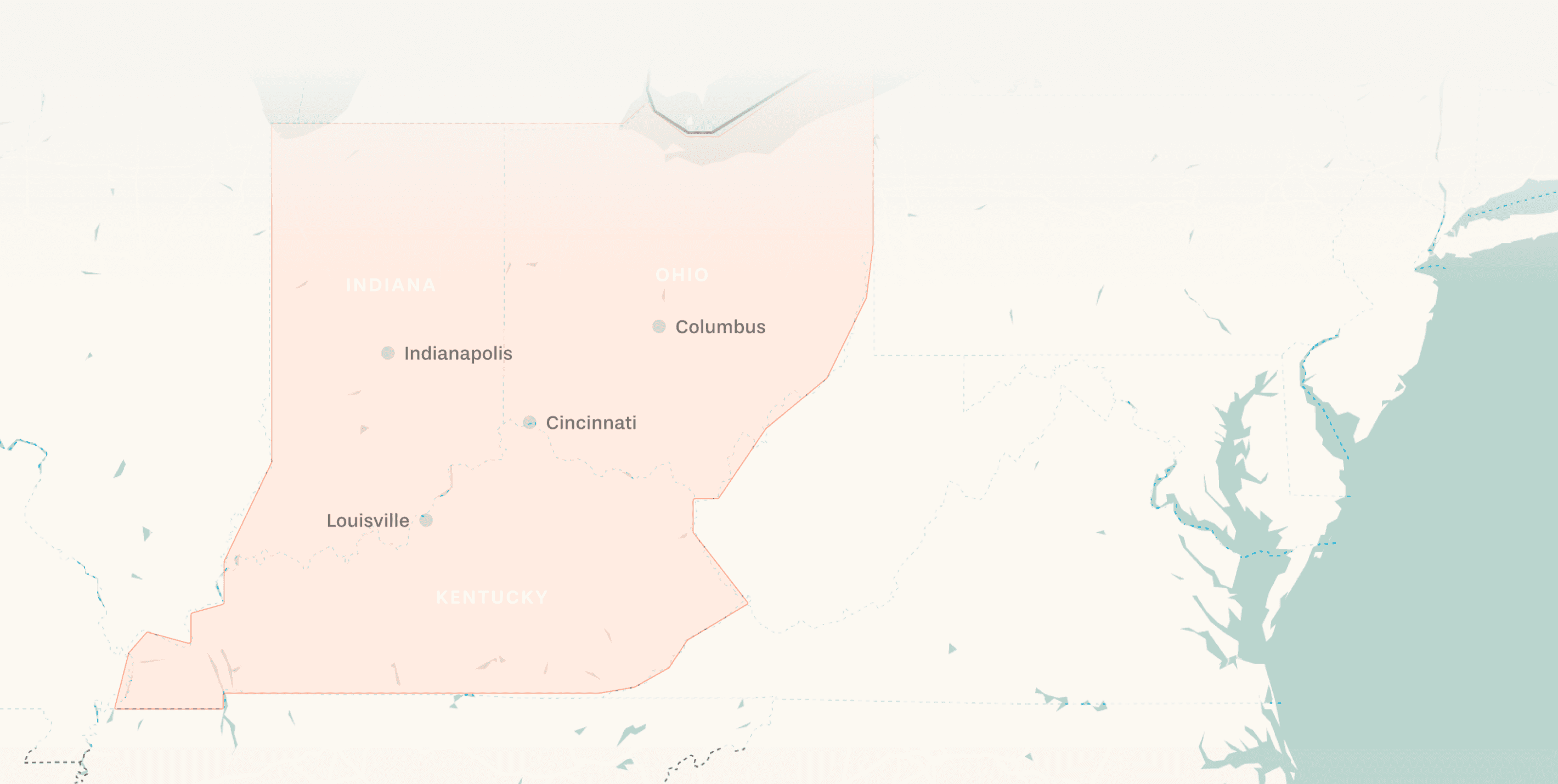

Target Markets

Midwest metros with stable demand and favorable rent-to-purchase ratios

Each acquisition is conservatively underwritten, with a focus on income stability, operational efficiencies, and no assumptions of speculative appreciation.

HOW YOU BENEFIT

Multiple advantages of multifamily real estate investing

Begin your wealth journey

Some moments Stop time

For Marc, it was sitting with his daughter eating ice cream in the middle of a weekday. No emails or deadlines to worry about, just the quiet realization that time sovereignty is real—and that passive income made it possible.

That moment is why LHS Legacy Capital exists. We help hardworking families turn their savings into steady income so they can focus on what truly matters: their time, their relationships, and their legacy.