Portfolio

Three Decades of Resilient Multifamily Investments

Portfolio

Three Decades of Resilient Multifamily Investments

Portfolio

Three Decades of Resilient Multifamily Investments

Portfolio

Three Decades of Resilient Multifamily Investments

Each property is acquired with conservative underwriting and immediate cash flow.

Our Track Record

TOTAL UNITS acquired

average projected IRR

average CoC

State-Diversification

Our Portfolio

Lindale Ave

Active

Location or small Description

7 Units

Acquired in 1999

Purchase Price $240,000

Current CoC 122%

Lindale Ave

Active

Location or small Description

7 Units

Acquired in 1999

Purchase Price $240,000

Current CoC 122%

Lindale Ave

Active

Lindale Ave acquired small 7 unit property in a great location with seller financing to hold long term.

7 Units

Acquired in 1999

Purchase Price $240,000

Current CoC 122%

Lindale Ave

Active

Lindale Ave acquired small 7 unit property in a great location with seller financing to hold long term.

7 Units

Acquired in 1999

Purchase Price $240,000

Current CoC 122%

Broad Street

Active

Location or small Description

12 units

Acquired in 2002

Purchase Price $630,000

Current CoC 32%

Broad Street

Active

Location or small Description

12 units

Acquired in 2002

Purchase Price $630,000

Current CoC 32%

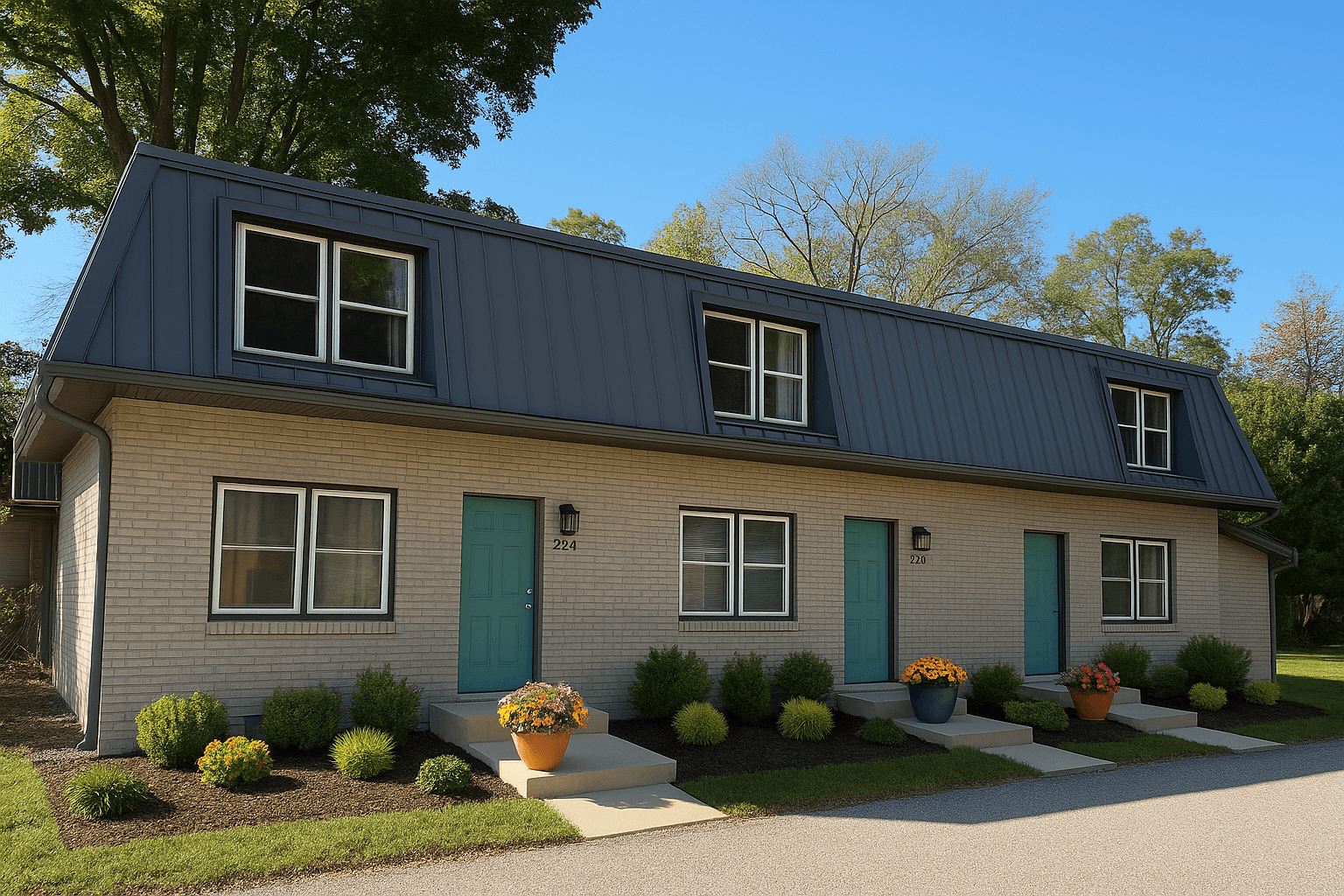

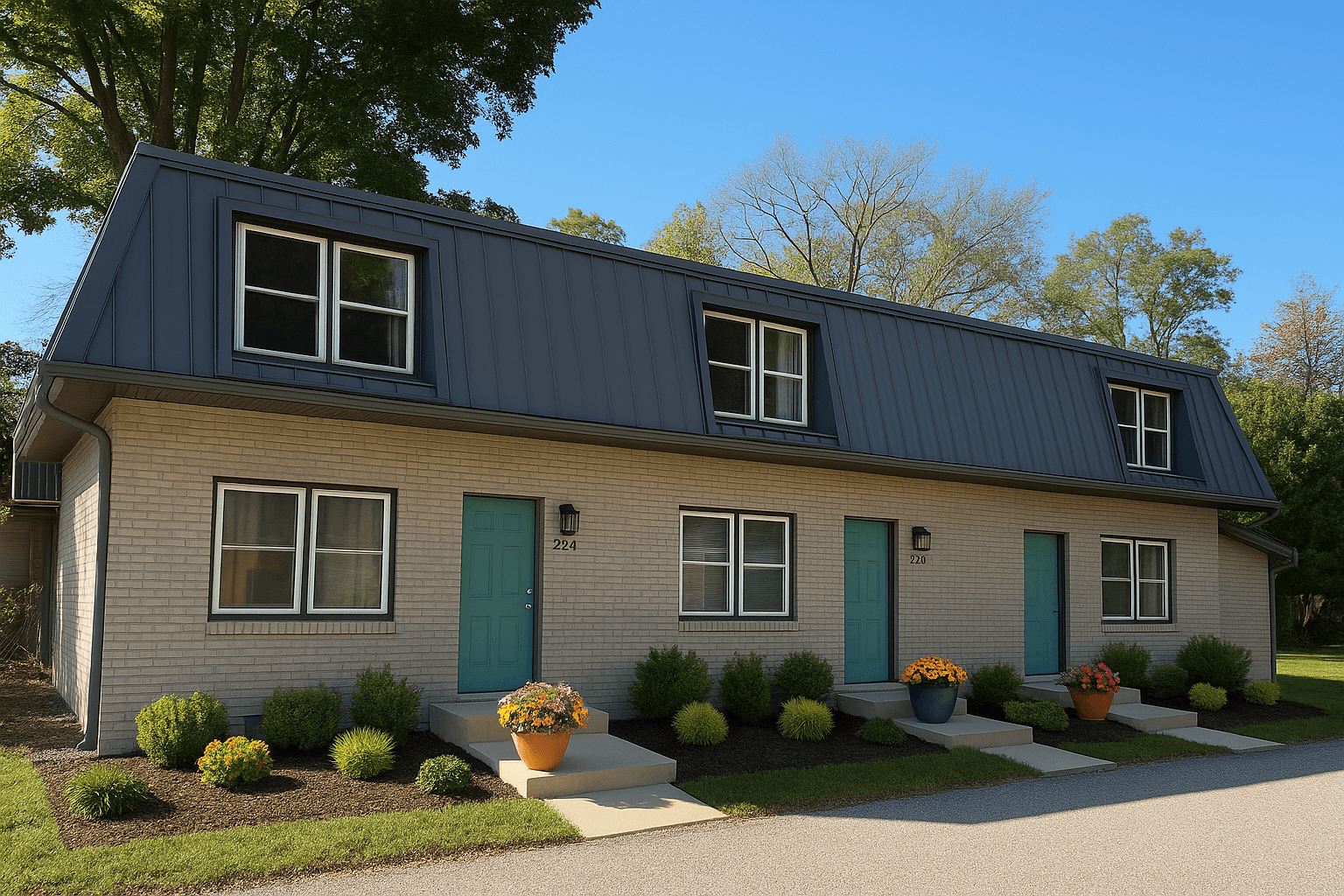

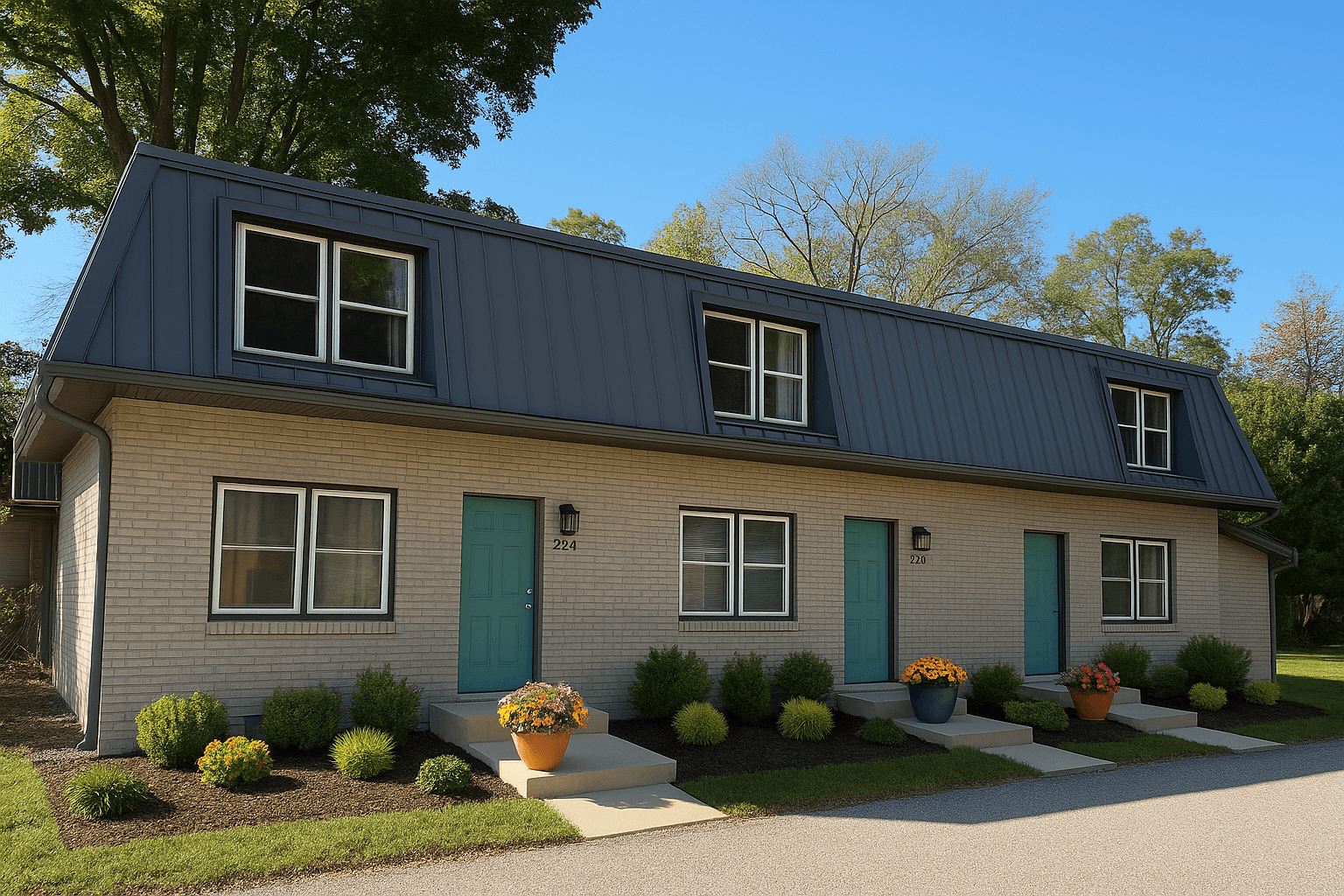

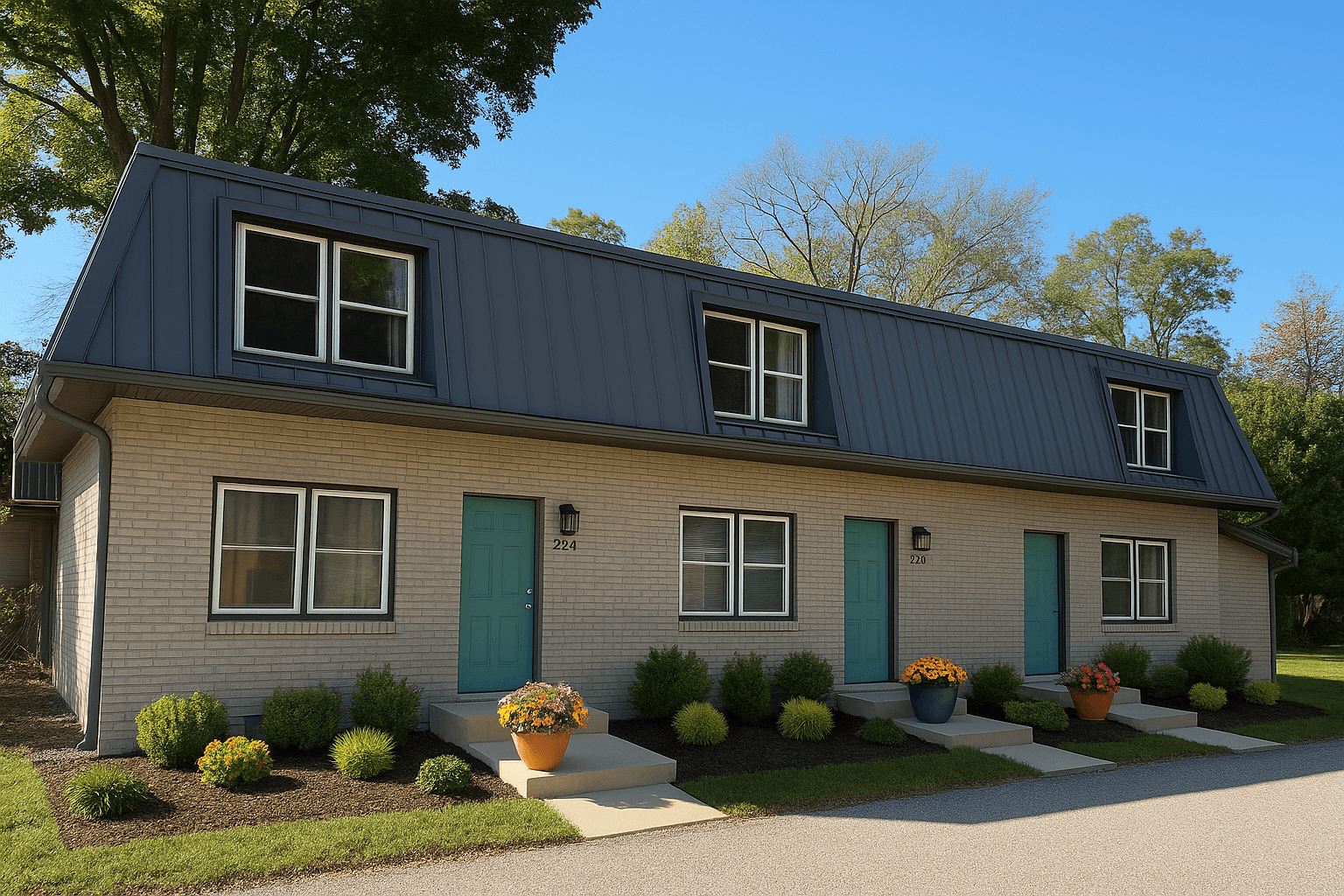

Broad Street

Active

Broad street All brick construction property located near Ashland University value add and long term hold.

12 units

Acquired in 2002

Purchase Price $630,000

Current CoC 32%

Broad Street

Active

Broad street All brick construction property located near Ashland University value add and long term hold.

12 units

Acquired in 2002

Purchase Price $630,000

Current CoC 32%

Residential Portfolio

Active

Location or small Description

Portfolio of smaller properties

Average CoC 132%

Residential Portfolio

Active

Location or small Description

Portfolio of smaller properties

Average CoC 132%

Lakeview Apartments

Closed

Location or small Description

24 units

Purchased in 1995 for $450,000

Sold in 2007 for $600,000

IRR 34%

Lakeview Apartments

Closed

Location or small Description

24 units

Purchased in 1995 for $450,000

Sold in 2007 for $600,000

IRR 34%

Lakeview Apartments

Closed

24 units

Purchased in 1995 for $450,000

Sold in 2007 for $600,000

IRR 34%

Lakeview Apartments

Closed

24 units

Purchased in 1995 for $450,000

Sold in 2007 for $600,000

IRR 34%

Evergreen Apartments

Closed

Location or small Description

57 units

Purchased in 2001 for 1,000,000

Sold in 2003 for 1,310,000

IRR 17%

Evergreen Apartments

Closed

Location or small Description

57 units

Purchased in 2001 for 1,000,000

Sold in 2003 for 1,310,000

IRR 17%

Evergreen Apartments

Closed

Evergreen apartments short term fix and flip by renovating 20% of the units and stablize.

57 units

Purchased in 2001 for 1,000,000

Sold in 2003 for 1,310,000

IRR 17%

Evergreen Apartments

Closed

Evergreen apartments short term fix and flip by renovating 20% of the units and stablize.

57 units

Purchased in 2001 for 1,000,000

Sold in 2003 for 1,310,000

IRR 17%

Columbus Circle Apartments

Closed

Location or small Description

24 Units

Purchased in 2004 for $728,000

Sold in 2022 at 1,850,000

IRR 23%

Columbus Circle Apartments

Closed

Location or small Description

24 Units

Purchased in 2004 for $728,000

Sold in 2022 at 1,850,000

IRR 23%

Columbus Circle Apartments

Closed

Columbus Circle apartments. long term cash flow purchase with favorable creative financing terms.

24 Units

Purchased in 2004 for $728,000

Sold in 2022 at 1,850,000

IRR 23%

Columbus Circle Apartments

Closed

Columbus Circle apartments. long term cash flow purchase with favorable creative financing terms.

24 Units

Purchased in 2004 for $728,000

Sold in 2022 at 1,850,000

IRR 23%

Access Future Offerings

Our investor group is the entry point to every deal we bring forward. Join today to review offerings as they become available.

Our investor group is the entry point to every deal we bring forward. Join today to review offerings as they become available.

LHS Legacy Capital offers investments under Regulation D Rule 506(c), available only to verified accredited investors. These investments are illiquid, not guaranteed, and involve risk of loss, including loss of principal. Historical returns are not indicative of future results. All projections and targets are for informational purposes only and should not be relied upon to predict future performance.

LHS LEGACY CAPITAL @ 2025. All rights reserved.

LHS Legacy Capital offers investments under Regulation D Rule 506(c), available only to verified accredited investors. These investments are illiquid, not guaranteed, and involve risk of loss, including loss of principal. Historical returns are not indicative of future results. All projections and targets are for informational purposes only and should not be relied upon to predict future performance.

LHS LEGACY CAPITAL @ 2025. All rights reserved.

LHS Legacy Capital offers investments under Regulation D Rule 506(c), available only to verified accredited investors. These investments are illiquid, not guaranteed, and involve risk of loss, including loss of principal. Historical returns are not indicative of future results. All projections and targets are for informational purposes only and should not be relied upon to predict future performance.

LHS LEGACY CAPITAL @ 2025. All rights reserved.

LHS Legacy Capital offers investments under Regulation D Rule 506(c), available only to verified accredited investors. These investments are illiquid, not guaranteed, and involve risk of loss, including loss of principal. Historical returns are not indicative of future results. All projections and targets are for informational purposes only and should not be relied upon to predict future performance.

LHS LEGACY CAPITAL @ 2025. All rights reserved.

LHS Legacy Capital offers investments under Regulation D Rule 506(c), available only to verified accredited investors. These investments are illiquid, not guaranteed, and involve risk of loss, including loss of principal. Historical returns are not indicative of future results. All projections and targets are for informational purposes only and should not be relied upon to predict future performance.

LHS LEGACY CAPITAL @ 2025. All rights reserved.